Banking & Finance Courses

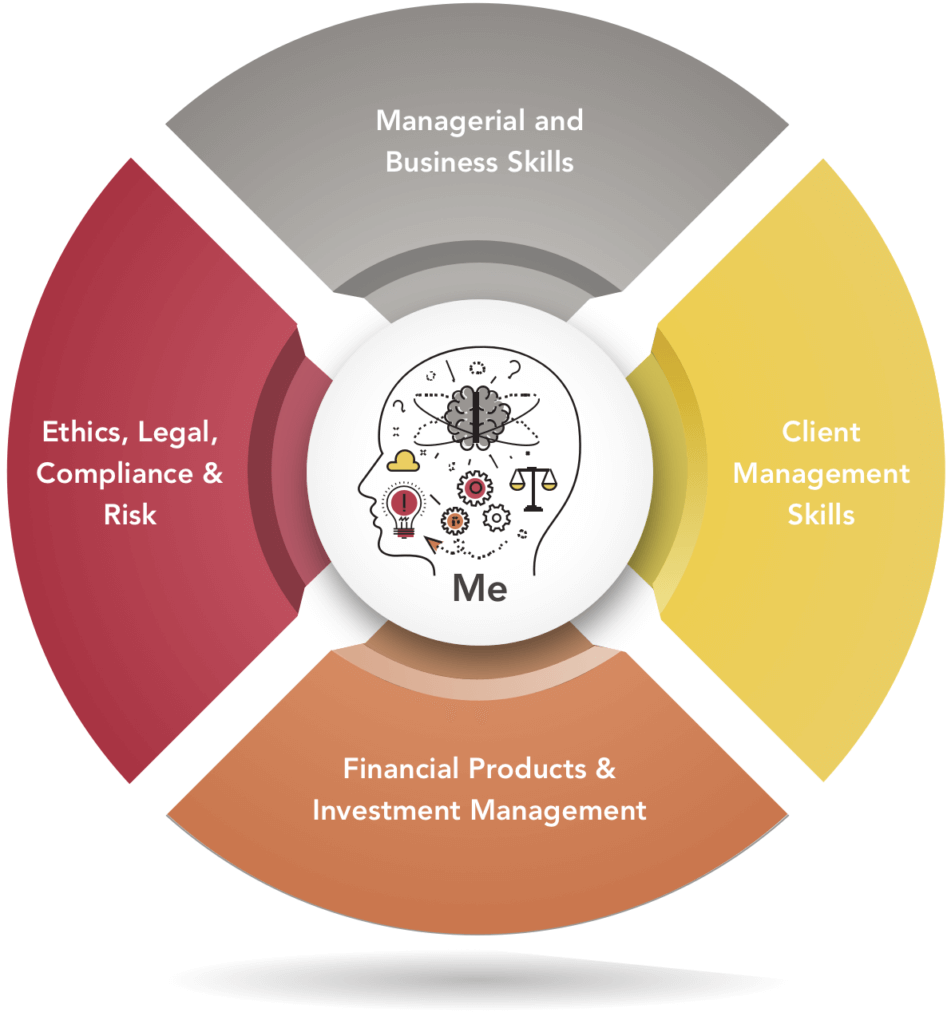

The Fintelligence Course Catalogue consists of onsite-programs and online-modules in the four main areas of expertise:

- Managerial and Business Skills

- Client Management Skills

- Financial Products & Investment Management

- Ethics, Legal, Compliance & Risk

All programs and online modules contain assessments and tests and are available in several languages, primarily in English, French, German and Italian.

Managerial and Business Skills

Business Strategy (3)

- Creating Blue Oceans (sustainable competitve advantages) and analyze tools and frameworks

- Reconstruct market boundaries

- Focus on the picture, not the numbers

- Reach beyond existing demand

- Get the strategic sequence right

- Overcome key organizational hurdles

- Buid execution into strategy

- Conclusion: Sustainability and renewal of Blue Ocean strategy

- Methods to invent and introduction to out-of-the-box thinking

- Methods to anticiapte and solve problems

- Business case: Innovative strategic decision

- Work on action plan for own solution

- Judgement and choice biases (framing, endowment bias, availability bias, heuristics, anchoring, mental accounting)

- Consuming statistical data (biases samples, regression to the mean, correlation and causation)

- Decisions under risk (measurement of utility, risk aversion, prospect theory)

- Decisions under uncertainty (subjective probability, causality, the sure thing principle)

- Red flags and safeguards

- Pulling it all together

IT Skills (5)

- Customising quick access toolbar

- Navigation

- Importing data

- Data management and analysis

- Logical statements

- Data mining with Excel

- Charting, including bridge charts

- Goal seek

- Conditional optimisation using solver

- Spreadsheet auditing and debugging

- Quick tour of key features

- Customising quick access toolbar

- Creating folders to improve productivity

- Working with Tasks

- Working with Calendar

- E-mail etiquette

- Custom formulae and functions

- Recording macros

- Creating macros from scratch

- Forms, buttons and drop-down menus

- Debugging VBA code

- Quick tour of key features

- Creating a presentation from a Word document

- Formatting slides, text, shapes and images

- Using tables, charts, Smart Art and Media

- Using content from other presentations

- Case studies

Leadership Skills (6)

- Analysis of target group and desired outcomes of communication

- Selection of media and styles of communication

- Application of communication strategy in a given context

- Presentation skills and practicing opportunities

- Go through a systematic approach and become master of your own business

- Segment your market and build a end user profile (persona)

- Product / services specialisation and value proposition

- Define your core and chart your competitve position

- Do the calculations and design your business model (incl. pricing)

- Calculate the life time value of acquired customer and the cost of customer acquisiton

- Develop a product plan in detail

- Start communications of your offering

- Leadership practices – how to be effective as a leader and manager

- Receive feedback from team leaders

- Model the way

- Inspire a shared vision

- Challenge the process

- Enable others to act and to deliver

- Encourage the hearts

- Bring it all together

- The principles of coaching (the art of inquiring, goal setting and reality testing)

- The practice of coaching (learning and enjoyment, motivation and self-belief, feedback and assessment) and mentoring

- Leadership for high performance

- Transformation through transpersonal coaching

- Benefits of managing and maintaining a professional network

- Ways of networking (physical, digital) and ways of getting introduced to further parties

- Map your own network of stakeholders

- Individual action plan

- What are the key elements of effective training and learning? How do adults learn best?

- How to overcome barriers to learning – how to create a long lasting learning impact (incl. learning transfer)

- How to engage participants and design/facilitate an effective training session

- Communication and presentation skills

Management Techniques (12)

- What are difficult conversations? How to master difficult conversations?

- Start with heart, learn to look, make it safe

- State my path, explore others paths

- Move to action, putting it all together

- Practice and receive feedback from others

- Phases of business meeting

- Analysis of stakeholders of meetings; chairing of meetings

- Planning and preparating of meetings (setting the agenda right)

- Conducting and facilitating the meeting

- Smart follow up (hold stakeholders responsible)

- Sources and causalities of stress

- Ways of handling stress effectively

- Become stress-resilient and resourceful in future situations

- Analysis of individual situations and action plan

- Separate appreciation, coaching, and evaluation

- Understand benefits of receiving and giving feedback

- Understand and see your blind spots

- Do not switchtrack

- Dimantle distortions and cultivate a growth identity

- Get going, pull together, learn and move ahead

- Understand styles of business writing and their purpose

- Understand target audience and goal of communication

- Choice of vocabulary and style

- Facts versus opinions / feelings

- Ways of planning and setting priorities

- Checking on your actual and future resources

- Setting individual priorities consciously and realistically, explore potential conflicts

- Develop action plan

- Understanding the business of banking and finance

- Expectations from the bank and the business (incl. ethics, code of conduct)

- Business etiquette

- Setting priorities and action plan

- Self management (how to set priorities, understand your strengths and weaknesses)

- What is delegation – models of effective delegation

- The line manager and delegation

- Delegation, instruction and monitoring (skill / will matrix, key elements of delegation)

- The planning of delegation (trust and delegation)

- Recuritment process and job profiles

- Various difficulties of selection

- Competencies, experiences, and potential

- Questioning techniques and evidences

- Asking smart follow up questions

- Interviewing for motivational fit

- Data integration and making conclusions

- Insights into talent development (e.g. potential vs. individual performance)

- Evaluate and position your team’s talents, profile their performance and potential

- Understand the goals that have been set for the individual talents and evaluate the demonstrated behaviors

- Check on the talents’ ability to learn, career aspiration, engagement, motivation and resilience

- Prepare the appraisal and talent conversation and anticipate feedback from talents

- Define appropriate actions and set next milestones

- Understanding development measures (incl. coaching and mentoring)

- Differences between leadership and management

- Typical roles of team members and team dynamics

- Situational leadership

- The “what happened” conversation, the feeling conversation and create a learning conversation

- Seperate the people from the problem

- Focus on interestes of the parties and not on their positions

- Action plan

- Pitfalls in projects

- Roles and responsibilities in projects and stakeholder management, project governance, project sponsor and organization

- Excellence in planning and setting appropriate goals

- Projects and change

- Financial analysis

- Project crisis, does and don’ts

- Tools and instruments

- Action points and next steps

Client Management Skills

Personal Skills (4)

- Introduction to various styles of personality and communication

- Obtain extensive feedback on own personality and communication styles and behaviour preferences from superiors, colleagues, and clients

- Introduction to Johari’s Window – plan, practice with colleagues and / or line manager

- Develop follow up and action plan

- Perspectives on trust (What is the Trusted Advisor? Earning trust, how to give advice – sincerity or technique)

- The process of trust building (the trust equation, the development of trust, engagement, the art of listening, framing the issue, envisioning an alternate reality, commitment)

- Putting trust to work (different client types, re-earning trust from the current deal, the case of cross-selling, the quick-impact to gain trust)

- Practice and follow up

- Introduction to personality typology and benefits of their use by relationship manager

- Identification of personality profiles, their differences and the associated behaviour and communication preferences

- Recognize own personality profile and own preferred behavioral and communication style

- Peculiarities of communication between people of various profiles

- Ways of adapting own communication style in relations to clients (various profiles)

- Categorization of own clients according to personality typlogy and definition of the next steps in dialogue with clients

- Aspiring to be resilient and agile in various perspectives

- Leveraging on self-awareness, self-regard, and self-actualization

- Increasing emotional expression, independence, and assertivness

- Building up interpersonal relationships, empathy, and social responsibility

- Master in stress management (flexibility, stress tolerance and optimisim)

- Move ahead in reality testing, problem solving and impulse control

Post-Sales Skills (4)

- Analyze client book and prospect pipeline

- Propose adequate solutions

- Negotiating the deal

- Create a win-win and consequence selling

- Handling objections – working through pain points

- From rapport to relationship, gaining commitment

- Practical sessions to apply learnings

- Create client strategies to deepen and broaden relationships with clients

- Implement tailored communication plans that secure client relationships and help to spot additional opportunities

- Create and implement an individual system for renewing clients’ situations regularly to create opportunities

- Recognize when clients are at risk of leaving bank and take appropriate counteraction

- Convert customer complaints into opportunities to increase client satisfaction

- Leverage satisfied clients to gain referrals

- Analysis of current client base and prospect pipeline

- Exploration of networking opportunities and referrals via current client base, creating your strategic network map

- Methods of networking and introductions to prospects

- Analysis of current client base, product penetration, and sensitivity to price

- Explore opportunities with existing clients and check potential product bundles, sharing best practices

- Develop action plan how to cross-sell with current clients

Pre-Sales Skills (3)

- What are your USP (Unique Selling Propositions)?

- What are the USP of your institutions?

- Reflect on these specific areas and present to colleagues

- Practice and develop a convincing introductory sales pitch, video tape

- Receive feedback from colleagues, action plan how to move ahead

- Communicate with high impact at client meetings (inital and follow up meetings)

- Effectively acquire new clients through cold leads, warm leads, and hot leads

- Understand how to positively position offering to clients

- Understand how to argue with benefits in conversations with clients and present client a variety of opportunities

- Be prepared to face objections and understand how to respond

- Role play and obtain helpful inputs to develop your own practice

- Understanding current client base (profiling of clients) in terms of current / future profitability and other indicators

- Understanding current and anticipate future client needs (incl. interviewing techniques and active listening)

- Map the client base of the future with clear forecasts of revenues and product penetration

Sales Techniques (5)

- How to interact with clients and how to obtain information that is important for the setting up of the relationship to the client

- Benefits of using open / clarifying / probing questions – understanding and practicing

- The various ways of communicating and listing (roles of communicator and listener)

- Active listening vs. other ways of listening

- The benefits and barriers of active listening

- Practice questioning techniques and active listening

- High impact communication (target group, channels, tone and frequency; belief, energy and invovlement)

- How other see you, how you see others

- Creating your personal brand

- Persuasion tools and techniques

- Action plan and next steps

- Understanding of revenue streams for various client groups

- Understanding current and future revenues

- Analyzing current client book and prospect pipeline

- Develop strategy for prioritization and acquisition strategies for various client groups

- Develop action plan with concrete follow up activities

- Look at various phases of the preparation

- Review information on client that you already gathered so far

- Do additional research from various sources

- Know and practice personal introduction (incl. bank and investment approach)

- Plan the structure of the meeting and the agenda

- Identify areas you want to explore OPEN questions and conduct structured interview questionnaire

- Separate people from problem

- Focus on interests of the parties and not on their positions

- Invent options for mutual gain (in order to achieve win-win)

- Define objective criteria that allow you to assess “good and / or acceptable solution”

- BATNA and JUJITSU

- Practice with actual examples from your professional practice

Financial Products & Investment Management

Fixed income investments (9)

- Function of the interest rate and essential characteristics of interest rates

- Submarkets for fixed income investments

- Basic features of a bond

- How bonds are issued in the primary market

- Trading of bonds in the secondary market

- Relationship between yields and bond prices

- Calculation of bond yields

- Time value of money and compound interest

- Conventional bond pricing

- Term structure of interest rates

- Interest rate risk and duration

- Difference between capital and money markets

- Essential features of money markets

- Money market instruments

- Use and suitability of money market instruments in client portfolios

- Bond issuers (corporate, sovereign, supranational, emerging markets)

- Bond types (vanilla bonds, convertible bonds, bonds with warrants, floating rate notes, medium term notes)

- Valuation of convertible bonds

- Secured vs. unsecured bonds

- Seniority of creditors

- Fixed vs. floating charge

- Subordinated bonds

- Contingent convertible (co-co) bonds

- Securitisation – asset backed securities and mortgage backed securities

- Foreign bonds, Eurobonds and dual-currency bonds

- Callable bonds

- Green bonds

- Issuance of bonds

- Direct vs. intermediated issues

- Private placement

- Offers for subscription

- Issuance by auction

- Bond issuance process (mandate, forming syndicate, underwriting, allocation, listing)

- Selecting appropriate strategy based on client suitability

- Client ability and willingness to take risk

- Bond strategies by risk, liquidity and expected return

- Tax aspects

- Components of fixed income returns – income and capital gains

- Accrued interest

- Bond strategies in low interest environments

- Conventional bond valuation

- Arbitrage-free valuation, using spot rates

- Clean price, dirty (full) price and accrued interest

- Daycount conventions for calculation of accrued interest

- Case study: Confirming the price of a corporate bond from Refinitiv / Bloomberg screen

- Motivation for securitisation

- Classification of instruments by type of securitised asset (RMBS, CMBS, ABS)

- Mechanics of securitisation

- Tranche structures (by payment priority, by prepayment / extension risk, by interest structure)

- Case studies of recent issues

Equities (5)

- What is a share?

- Rights of shareholders

- Definition and key principles of corporate governance

- Types of shares (ordinary, preference, convertible preference)

- Issuance of shares

- Rights issues

- Share splits and reverse splits

- Share buybacks

- Primary vs. secondary markets for shares

- Methods of issuing shares

- IPO process

- Listing and secondary market trading of shares

- Order types

- Off-exchange trading

- Equity indices (major indices, weighing methods, total return vs. price indices)

- Principles of company valuation

- Asset-based valuation (role of goodwill in company valuation)

- Cash-flow based valuation (dividend discount models, DCF models)

- The average value (combined) method

- Comparison of fundamental, technical and behavioral analysis

- Top-down fundamental analysis (macroeconomic analysis, industry analysis, company analysis)

- The concept of intrinsic value

- Dividend discount models vs. relative valuation (multiplier) approaches

- Key ratios in equity analysis (PE, PEG, Shiller PE ratio, cash-flow based ratios, EV / EBITDA)

- Principles of technical analysis

- Principles of behavioral analysis

- Role of equity investments in portfolios

- Suitability of equities based on client profile

- Equities and currency risk

- Trading frequency and role of transaction costs and taxes

- Diversification

- Active and passive equity strategies

- Economic cycle

- Cyclical vs. defensive shares

Portfolio Management (7)

- Calculation of returns (simple yield, time-weighted rate of return, capital-weighted rate of return, annualisation of returns)

- Definition and calculation of risk (volatility, normal distribution, skewness and kurtosis)

- Systematic vs. specific risk

- Role of diversification in reducing risk

- Correlation and its effect on diversification

- The efficient frontier and the capital market line

- Introduction to the capital asset pricing model and beta as a measure of risk

- Risk-adjusted performance measures (Jensen’s alpha, Sharpe ratio, Treynor ratio)

- The investment process (planning, execution and feedback)

- The importance of asset allocation in portfolio risk and returns

- Strategic vs. tactical asset allocation

- Optimal allocation based on client profile

- Benchmarking

- Tactical asset allocation

- Active vs. passive portfolio management

- Market efficiency and active strategies

- Top-down vs. bottom-up strategies

- Execution of asset allocation decisions

- Performance measurement (tracking error, information ratio)

- GIPS

- Typical portfolio strategies (capital protection, capital growth, balanced, income, long-term growth)

- The core-satellite approach

- Case studies (selecting most appropriate strategy based on client profile)

- Obtaining data and verifying reliability

- Selecting calculation methodology based on use and external cash flows (TWRR, MWRR, Linked-IRR)

- Selecting appropriate benchmarks

- Adjusting returns for risk – risk adjusted performance measurement

- Evaluation of benchmark appropriateness

- Selecting appropriate attribution methodology (micro attribution, macro attribution, fixed income attribution, multiperiod return attribution)

- Understanding impact of investment decisions on performance (market timing, allocation, security selection)

- Factors affecting liabilities

- Calculating PV of fixed and inflation-sensitive liabilities

- Matching liabilities using securities and derivatives

- Implementation

Macroeconomic aspects (5)

- The importance of the macroeconomic environment on investment risk and returns

- The circular flow of the economy

- Measuring macroeconomic output

- Loss of purchasing power; measuring inflation

- Nominal vs. real prices and interest rates

- Analysing savings and investments

- Functions of money

- Measuring the money supply

- Determinants of supply and demand for money

- Monetary policy and the role of the central bank

- Understanding mechanisms of monetary policy

- Central banks’ approach to monetary policy

- Implication of inflation and deflation on economic growth

- Measures of economic growth

- Definition and tools of fiscal policy

- Supply- and demand-driven fiscal policy

- Government finances and national debt

- Case study: The Maastricht Treaty and indebtedness of EU member countries

- Definition and components of balance of payments

- The current account

- Interaction of current account and national savings and investments

- Fiscal vs. current account deficits

- How to manage current account deficits

- Exchange rate regimes (flexible, controlled float, pegging, monetary union)

- Determinants of exchange rates

- Real vs. nominal exchange rates

- Impact of exchange rates on the wider economy

Derivatives (11)

- What are derivatives?

- Key types of derivatives explained (forwards, futures, swaps and options)

- Where and how can derivatives be traded

- Uses of derivatives in portfolio management

- Assessing suitability of derivatives for clients

- Understanding option types (call vs. put options, long and short positions)

- Option expiry types (American vs. European)

- How to decide if / when to exercise option

- Option position payoff profiles

- Calculating profits / losses of option positions

- Components of option premiums (intrinsic value, time value)

- Determinants of option values (price of the underlying, income, time to expiry, interest rates, volatility)

- Which factors are most important for call and put options

- Sensitivity of option values to changes in factors

- Intrinsic (fair) vs. theoretical (time) value of options

- Valuation of options using the Black-Scholes formula

- Valuation of options using Excel and other options calculators

- Put-call parity

- What are option indicators?

- Static vs. dynamic indicators

- Importance of static indicators (premium, leverage, break-even)

- Importance of dynamic indicators (Delta, Gamma, Vega, Theta, Rho, Omega)

- Matching market opinions to derivative strategies

- Four basic option strategies

- Hedging and speculating with options

- Directional and volatility bets

- Yield enhancement strategies

- Four key uses of options (speculation, hedging, return enhancement, arbitrage)

- Option spreads and combinations (bull and bear spreads, straddles and strangles)

- Use of options in client portfolios

- Digital options; their definitions and risk-return profiles (binary options, all-or-nothing options)

- Path dependent options; their definitions and risk-return profiles (barrier options, Asian options)

- Rainbow options; their definitions and risk-return profiles (outperformance options, best-of options, worst-of options)

- Definition of swaps

- Swap terminology

- Trading of swaps (role of central counterparties, Standardisation of contracts)

- Types of swaps (interest rate swaps, commodity swaps, currency swaps, credit default swaps)

- Principles of pricing and valuation of swaps

- Using swaps to hedge interest rate exposures

- Using swaps to speculate

- Using swaps to change asset allocation

- Creating synthetic portfolios using swaps

- Definition of volatility

- Historic vs. implied vs. realised volatility

- Sensitivity of options to volatility

- Volatility-related instruments

- Is volatility a comprehensive measure of risk?

Investment funds (4)

- Different types of investment funds (collective investment schemes) in Switzerland, EU and the UK

- Open vs. closed investment schemes

- How to pick the most appropriate fund structure for your clients

- Fund strategies – active vs. passive

- Equity fund types and strategies

- Fixed income fund types and strategies

- Money market funds

- Sustainability funds

- Exchange traded funds (ETFs)

- Multi-asset fund types and strategies

- Absolute- and relative-return funds

- Real estate and commodity funds

- Definition and calculation of the Net Asset Value (NAV)

- Evaluation of fund fee structures (Calculating the Total Expense Ratio (TER))

- Direct and indirect costs of investing in funds

- Primary and secondary markets for units in funds

- Fund ratings and rankings explained

- Overview of taxation of fund investments (Switzerland, EU and UK)

- Withholding tax

- Taxation of capital gains vs. income

- The role of funds’ and investor’s location

Loans and mortgages (4)

- Economic function of banking systems

- Financial intermediation

- Characteristics of loans

- Covered vs. uncovered loans

- Credit risk management

- Types of consumer loans

- Overdraft facilities

- Leasing of consumer goods

- Bank loans

- Repayment of loans

- Lombard loans

- Significance of land register

- Real estate eligible for registration

- Easements and encumbrances

- Types of land ownership

- Key elements of real estate financing

- Valuation of real estate

- Property features and locations features

- Mortgage lending rules

- Types of mortgages

Business and company loans (7)

- Main characteristics of different legal company structures

- Sole proprietorships

- Partnerships

- Limited liability companies

- Stock companies

- Functions of the commercial register

- Market and sector positioning

- SWOT analysis

- Five Forces

- Product life cycle

- BCG matrix

- Business plan

- Structure of annual financial statements

- Balance sheet, income statement and cash-flow statement

- Importance of financial ratio analysis

- Capital and asset structure

- Liquidity analysis

- Key indicators for financial strength and profitability

- Threshold analysis for financial indicators

- Financial and liquidity planning

- Creditworthiness and ratings

- Intrinsic value

- Valuation principles and their limitations

- Earnings value

- Average value

- Discounted cash flow

- Economic profit

- Operating credit

- Overdraft facility

- Factoring

- Investment credit

- Financing vs. operating leasing

- Lombard loans

- Contingent credit

- Characteristics of guarantees

- Letter of credit

- Documentary collection

- Covenants

Structured products (6)

- What are structured products

- Recent developments and innovation

- Classifying structured products based on risk-return profile

- Role of structured products in client portfolios

- Categories of structured products (capital protection; yield enhancement; participation; leveraged)

- Mechanics of structured products

- Assessing risk-return profile of structured products

- Assessing client suitability of structured products

- What are capital protection products

- Subcategories of capital protection products

- Essential design features and function

- Risk-return profiles

- What are yield optimisation products

- Subcategories of yield optimisation products

- Essential design features and function

- Risk-return profiles

- What are participation products

- Subcategories of participation products

- Essential design features and function

- Risk-return profiles

- What are leverage products

- Subcategories of leverage products

- Essential design features and function

- Risk-return profiles

Alternative Investments (7)

- Foreign exchange markets and players

- Currency quotations

- Cross rates and arbitrage

- Exchange rate systems

- Convertibility and capital controls

- Spot transactions

- Forward and futures transactions

- Interest rate parity

- FX options

- European and American options

- FX swaps

- Non-deliverable forwards

- Precious metals as investment vehicle

- Determinants of the gold price

- Direct investments in precious metals

- Precious metals accounts

- Precious metals ETFs

- Gold mine shares

- Commodity categories

- Commodity indices

- Specific characteristics of commodity markets

- Cash vs. futures market

- Contango and backwardation

- Price determinants of commodities

- ETF and ETC

- Specific characteristics of real estate investments

- Real estate valuation

- Net present value

- Replacement cost

- Hedonic pricing

- Direct vs. indirect real estate investments

- Opportunities and risks

- REITs

- Organisation and regulation

- Fee structure

- Asset strategies

- Directional strategies

- Long short strategy

- Global macro strategy

- Event-driven strategies

- Merger arbitrage

- Distressed assets

- Relative value strategy

- Funds of hedge funds

- Focus of private equity investments

- Private equity strategies

- Leveraged buyouts

- Venture capital

- Direct and indirect investments

- Mezzanine capital

- Growth capital

- Distressed assets

- Exit strategies

Wealth Planning (3)

- Three pillars of the Swiss pension system

- State pension provision

- Private (self-invested) retirement products

- Health coverage in retirement

- Role of occupational pensions in the Swiss pension system

- Essential aspects and function of occupational pensions as pillar 2 in the Swiss system

- Voluntary contributions, early payouts and early retirement

- Nature and purpose of vested benefits foundations

- Characteristics and function of foundations, trusts and insurance products in private wealth management

- Assessing the suitability of foundations, trusts and insurance products for clients (tax considerations; estate planning; restrictive legislation in home country)

- Transparency requirements

Operations, Transactions and Treasury Management (4)

- Types of accounts for private and corporate clients

- Legal framework for opening an account (due diligence)

- General terms and conditions

- Powers of attorney

- Joint account

- Custody account

- Payment transaction systems

- Features of bank transfers and direct debiting

- Use of debit and credit cards

- Means of travel cash

- Functionalities of e-banking

- Key prerequisites for using cash management services

- Cash management services

- Liquidity planning and liquidity transfer

- Investment solutions

- Benefits of cash reporting and cash pooling

- Background and objectives of Global Custody

- Basic and comprehensive Global Custody solutions

- Settlement of securities transactions

- Corporate actions

- Reporting and tax claims

- Securities Lending

- Credit services

Wealth Management Advisory (3)

- Investment advice vs. asset management

- Typical asset management return strategies (capital protection, income and growth, balanced, growth, long-term growth)

- Core-satellite approach

- Case studies

- Life cycle of the investor

- Identifying and adjusting for life events

- Liquidity planning

- Risk capacity and risk appetite by life cycle phase

- Traditional vs. behavioral finance

- Key categories of behavioral biases

- How to identify behavioral biases in yourself and your clients

- How to address behavioral biases

Digitalisation (1)

- Impact of digital innovation on financial services and products

- Digitalisation of banking services

- Big data and artificial intelligence

- Robo-advisors

- Distributed ledger technology

- Tokenisation

- Crypto banks

Sustainability (1)

- Application of ESG (environmental, social and governance) criteria to sustainable products and services

- Sustainable investing and lending strategies (sustainability styles)

- Sustainability rating systems

- Bringing clients on board: Explaining the significance of sustainable investing to your clients

Intro to Global Capital Markets (1)

- This is a great introductory and interactive course, aimed at delegates who are new to financial markets

- What is financial intermediation?

- The circular flow model of the economy

- Role of banks

- Role of investment banks

- Securities markets and institutional investors

- Trends in global financial markets

Family Offices in Wealth Planning (1)

- Set of structures families can select from in order to manage and safeguard their assets

- Range of services Family Offices offer

- Insights into how Family Offices are governed

- How banks work and interact with wealthy families and their Family Offices in order to create value for them

Ethics, Legal, Compliance & Risk

Anti-money laundering (5)

- Compliance vs. Legal

- Compliance as a process, a organization unit and a function

- Supervision and sanctions

- National law and international regulations

- Process and phases of money laundering

- History of anti-money laundering

- Legal implications of money laundering

- Predicate offenses

- International regulations in the fight against money laundering

- AML scenarios and cases

- Due diligence obligations of financial intermediaries

- Dimensions of identification obligations

- Know-your-customer (KYC)

- Risk-based monitoring

- Suspicion of money laundering event

- Rules and principles of money laundering prevention

- Obligations when entering client relationships

- Identification of clients

- Determination of beneficial owners and controlling persons

- Increased risks

- AML scenarios and cases

- Risk classification

- Business relationships with high-risk clients, beneficial owners and controlling persons

- Politically exposed persons (PEPs)

- High-risk transactions

- Ongoing monitoring of client relationships

- Suspicion of money laundering and involvement of Compliance

- AML scenarios and cases

Codes of conduct (4)

- Principle of equal treatment of market participants

- Restrictions to proprietary market activities of employees

- Areas of confidentiality

- Insider information

- Market manipulation

- Rule violations and sanctions

- Different types of gifts

- Procedures to deal with gifts

- Guidelines to deal with inappropriate gifts

- Policy for gifts to clients

- Scenarios and cases

- Reputation and reputational risks

- Principles to safeguard reputation

- Legally permitted vs. socially tolerated behavior

- National and foreign standards

- Purpose and principles of conflict of interest policies

- Avoidance of conflicts of interest

- Disclosure and approval of conflicts of interest

- Information barriers (Chinese Walls)

- Cases and scenarios

Data security and confidentiality (2)

- Principles of data protection

- Correct handling of information and data

- Classification of information

- Proper handling of devices

- Use of E-mails, internet and mobile phones

- Working outside of the office

- Use of passwords

- Principles of confidentiality

- Objectives and scope of data security

- Bank client confidentiality

- Commercial secrecy

- Outsourcing and offshoring

Investment Suitability (1)

- Rules of conduct: honesty, good faith, professionalism

- Appropriateness and suitability

- Risk categorisation: risk capacity and risk propensity

- Opting up and opting down

- Financial products to be offered to different types of client

- Place of residence of the client

- Execution only, asset management contract and advisory mandate

Automatic exchange of information in tax matters (AEOI) (1)

- Common reporting standard

- AEOI mechanism

- Participating countries in AEOI

- Communication with clients

- AEOI scenarios and cases

Cross-border and FATCA (1)

- Principles of cross-border transactions

- Risks arising from cross-border business

- FATCA principles

- FATCA reporting models

- Criteria for US person

- Changes in US person status

Fraud Awareness (1)

- Characteristics of economic crimes

- Types of fraudulent action

- Liability and sanctions

- Preventive measures

- Fraud scenarios and cases

Fit for FinSA (1)

- Content and rationale of FinSA

- Client protection

- Financial services within the scope of FinSA

- Client segmentation

- Client profiling

- Assessment of appropriateness and suitability

- Pre-contractual information

- Basic Information Document and prospectus duty

- Execution – codes of conduct for transparency and diligence in client orders

- Documentation and accountability

- Applicability of MiFID in Switzerland